Introduction:

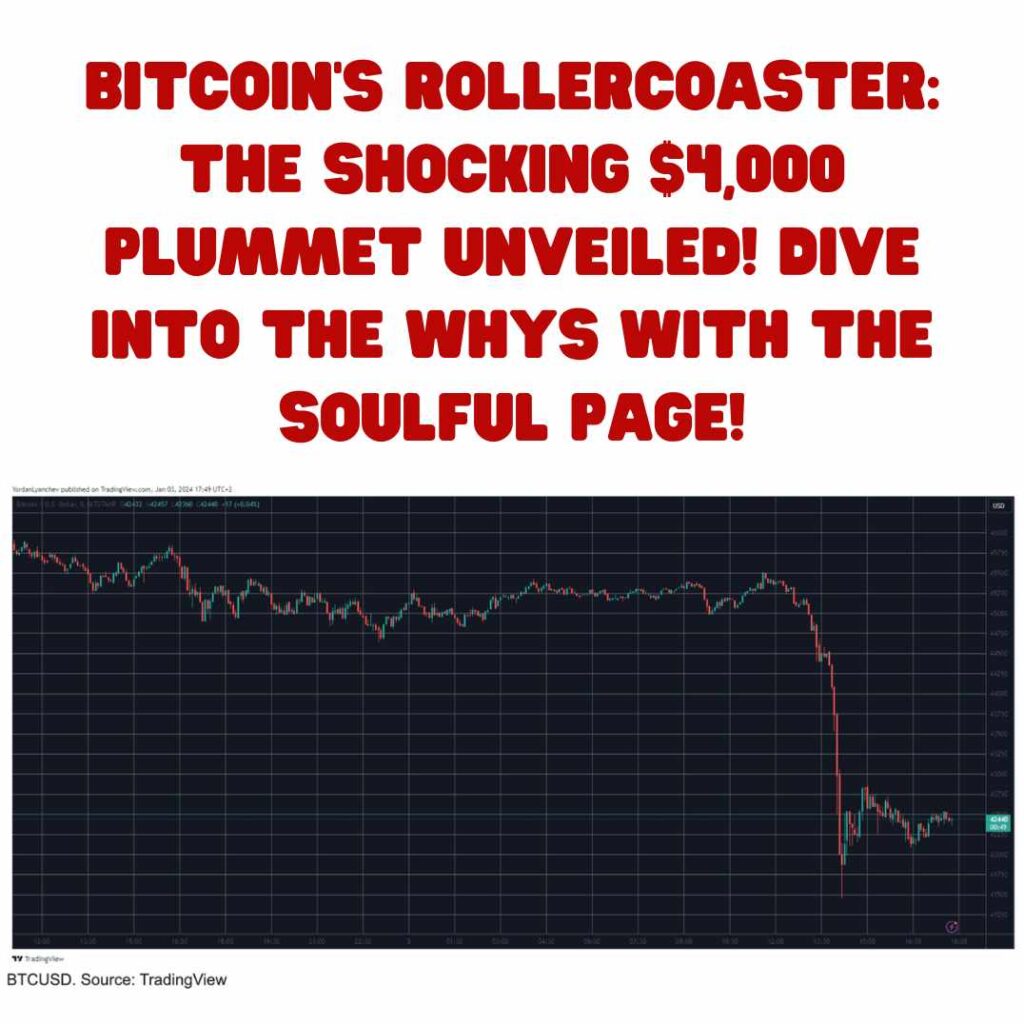

Bitcoin, the digital pioneer of cryptocurrency, experienced a sudden and sharp decline in value, negating the positive momentum it gained at the onset of 2024. This unexpected twist in its trajectory prompts us to explore the intricacies behind the rapid dip, shedding light on three potential reasons that may have contributed to this downturn.

Reason 1: SEC’s ETF Decision Uncertainty: A Regulatory Rollercoaster

The crypto community has been eagerly anticipating the decision of the US Securities and Exchange Commission (SEC) regarding the approval of a spot Bitcoin Exchange-Traded Fund (ETF). With major financial players like BlackRock and Fidelity involved, optimism ran high for a favorable decision in mid-January. However, recent reports hint at the SEC potentially rejecting all current ETF applications due to a lack of guidance on preventing market manipulation. While conflicting reports emerge, the uncertainty surrounding this significant regulatory decision has undeniably cast a shadow over the market, influencing Bitcoin’s abrupt price drop.

Reason 2: Miner Sell-Off Amidst Blockchain Challenges: Navigating the Hash Rate Surge

Bitcoin miners, the backbone of the blockchain, faced challenges amidst a surging hash rate and the imminent reduction of block rewards post the fourth halving. As the hash rate reached unprecedented levels, reports surfaced of significant Bitcoin deposits onto exchanges by large mining companies during the surge to $46,000. This pattern is often indicative of an impending sell-off. Balancing the need to cover operational costs and secure profits, miners engaging in sell-offs can exert downward pressure on Bitcoin’s value. The dynamics of this miner-driven sell-off add complexity to the evolving narrative of Bitcoin’s market movements.

Reason 3: Market Overhype and Greed: Riding the Volatility Wave

Bitcoin’s inherently volatile nature, coupled with its constant market activity, attracts both speculators and those seeking quick financial gains. Despite warning signals, such as the Relative Strength Index (RSI) reaching overbought territory on the 4-hour chart during the surge to $46,000, the market sentiment remained optimistic. The Fear and Greed Index, a gauge of investor sentiment, soared above 70, signaling heightened greed. As Warren Buffett wisely noted, heightened greed often precedes a market correction. The combination of overhype and greed in the market likely triggered profit-taking and a swift retracement in Bitcoin’s value.

Conclusion: Navigating Bitcoin’s Market Dynamics

Bitcoin’s journey through the financial realm continues to be marked by highs and lows, captivating and perplexing market observers. The three potential factors – SEC’s regulatory uncertainty, miner-driven sell-offs, and market overhype leading to greed – offer valuable insights into the multifaceted nature of Bitcoin’s price movements. As the cryptocurrency landscape evolves, understanding and navigating these fluctuations become imperative. Stay tuned with The Soulful Page for ongoing analysis and updates on Bitcoin’s fascinating journey within the dynamic world of finance.

What do you think?

It is nice to know your opinion. Leave a comment.