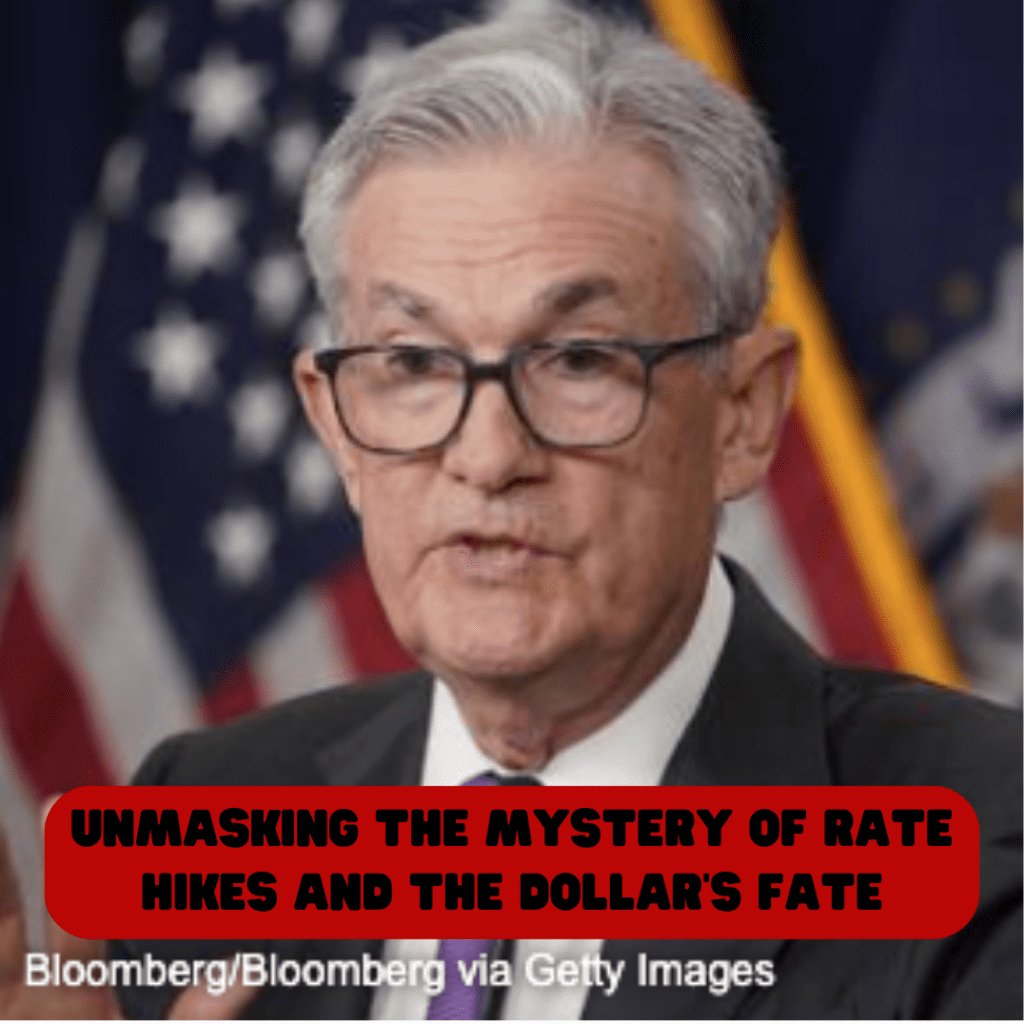

Federal Reserve Chairman Jerome Powell’s recent speech has ignited speculation within financial markets regarding potential rate hikes and their consequences on economic conditions. Powell acknowledged that the surge in bond yields has considerably tightened financial conditions, prompting contemplation of further adjustments to monetary policy should the economy sustain its above-trend growth. Nevertheless, he underlined the intricacy of managing this tightening amidst ongoing economic uncertainties, leaving room for speculation about the Federal Reserve’s forthcoming actions.

The Federal Reserve’s decision to maintain the policy rate within the 5.25%-5.5% range during September, along with the hawkish sentiment expressed in the Summary of Economic Projections, suggested the likelihood of an interest rate hike by year-end. However, evolving market dynamics and the complex interplay of macroeconomic data have complicated investors’ ability to predict the Federal Reserve’s future policy direction.

The notable surge in the benchmark 10-year US Treasury bond yield, rising from 4.5% to nearly 4.9%, has triggered concerns about a potential downgrade in the US debt rating. This surge in bond yields has fueled discussions among Federal Reserve policymakers about whether tightening financial conditions might act as a substitute for further rate hikes.

On the economic front, inflation remained persistent, with the “super core inflation” witnessing an uptick in September. Additionally, robust employment data and vigorous consumer activity have further muddied the waters of the rate outlook.

Market participants are eagerly awaiting Chairman Powell’s upcoming speech, as it holds implications for the US Dollar and bond yields. A dovish tone, hinting that the rise in bond yields could deter additional rate hikes, may result in a substantial depreciation of the USD, accompanied by a correction in bond yields. Conversely, a hawkish message that underscores the necessity of further rate increases driven by inflation and economic vitality could bolster the USD. A neutral stance may create a volatile yet indecisive market scenario, with investors preferring to await additional data, particularly the October jobs report, to make well-informed decisions.

In conclusion, the ongoing uncertainty regarding the Federal Reserve’s future actions and their consequences on economic conditions has introduced an element of unpredictability to the financial markets. While Powell’s forthcoming speech is anticipated to provide insights into the Federal Reserve’s next moves, market participants are maintaining a cautious and attentive stance, closely monitoring the evolving economic data landscape.

What do you think?

It is nice to know your opinion. Leave a comment.